Unlock Your Financial Potential: How a HELOC Can Transform Your Home Equity into Opportunity

Unlocking the Value of Your Home: The Power of a Home Equity Line of Credit

Introduction: Picture this: John and Sarah, a young couple in their mid-30s, recently realized that their home could be more than just a place to live—it could be a key to financial flexibility. Like many homeowners today, they were exploring ways to optimize their finances without disrupting their low mortgage rates. This is where their journey with a Home Equity Line of Credit (HELOC) began, and it could be the start of yours too.

What is a HELOC? A Home Equity Line of Credit, or HELOC, is a financial tool that allows homeowners to borrow against the equity in their homes. It’s a flexible option for accessing funds without the need to refinance your existing low-interest mortgage.

Why Consider a HELOC?

- Maintain Your Low Mortgage Rate: With a HELOC, you can access funds while keeping your current mortgage intact.

- Diverse Uses: From consolidating high-interest debts to funding home improvements or covering educational expenses, a HELOC offers a versatile solution.

Standalone HELOC: This is perfect for homeowners like John and Sarah, who wanted to tap into their home’s equity without affecting their favorable mortgage terms. It’s independent of who originated your mortgage and offers a straightforward way to access cash.

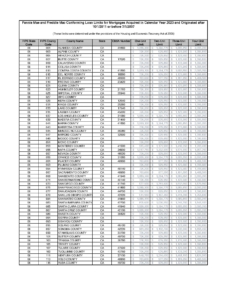

Piggyback HELOC: Ideal for new borrowers, this option allows you to secure a mortgage and open a HELOC simultaneously. It’s particularly useful for those needing extra funds for down payments or looking to qualify for a conforming loan.

Client Story: Take the case of Emily, a single mother who used a HELOC to fund her daughter’s college education. “The flexibility and ease of access to funds were a game-changer for me,” she shared. Emily’s story is just one of many where a HELOC has provided financial breathing room.

Key Benefits of Our HELOC:

- Flexible Withdrawals: Borrow from $25,000 to $500,000 as needed.

- Accommodating Credit Scores: We cater to a variety of financial situations.

- Variable Rate with Interest-Only Option: Tailor your payments to fit your budget.

- Broad Property Coverage: Suitable for various property types.

- Streamlined Appraisals: Quick and efficient process.

Understanding the Terms: Let’s break down some key terms:

- LTV (Loan to Value): This ratio determines the maximum amount you can borrow.

- Variable Rate: Your interest rate may change over time based on the market.

Your Path to Financial Flexibility: A HELOC with America One Mortgage Corporation is not just about accessing funds; it’s about empowering your financial future. Whether it’s for debt consolidation, home renovations, or educational expenses, we’re here to help you unlock the potential of your home equity.

Get Started Today: Ready to explore how a HELOC can benefit you? Contact us to start your journey towards financial flexibility. And remember, just like John, Sarah, and Emily, your home might just be the key to achieving your financial goals.

Homeownership is more than just a place to reside; it’s a valuable asset that can provide financial solutions when you need them most. With a HELOC from America One Mortgage Corporation, you’re not just borrowing money but investing in your future.

Call America One Mortgage Corporation

1-888-942-5626 or reach out to us at www.LoanRhino.Com